Top Guidelines Of Best Broker For Forex Trading

Top Guidelines Of Best Broker For Forex Trading

Blog Article

Best Broker For Forex Trading Things To Know Before You Get This

Table of ContentsHow Best Broker For Forex Trading can Save You Time, Stress, and Money.Best Broker For Forex Trading - The FactsWhat Does Best Broker For Forex Trading Mean?Unknown Facts About Best Broker For Forex TradingSome Ideas on Best Broker For Forex Trading You Should Know

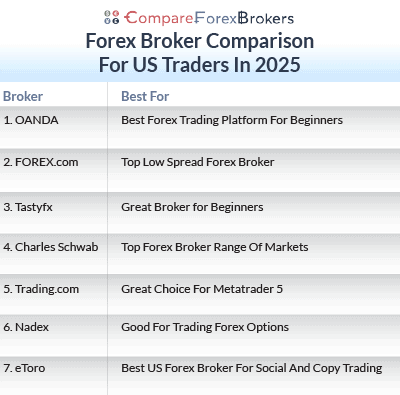

You must consider whether you can manage to take the high risk of losing your cash. In summary, it is really hoped that you currently have the needed expertise to find an on the internet foreign exchange broker that meets your requirements. Whether it is law, trading fees, deposits and withdrawals, consumer support, trading tools, or the spread you now recognize what to look out for when selecting a brand-new system.If you do not have the time to research platforms yourself, it might be worth checking out the leading 5 advised foreign exchange brokers that we have actually discussed above. Each forex broker masters a specific division, such as reduced charges, mobile trading, user-friendliness, or trust fund. Inevitably, simply ensure that you understand the risks of trading foreign exchange online.

This means that major foreign exchange sets are topped to take advantage of levels of 30:1, and minors/exotics at 20:1. If the broker is based in the UK, then it must be regulated by the FCA.

With such a large market, there will certainly be constantly somebody happy to buy or sell any kind of currency at the priced estimate rate, making it simple to open and shut professions or deals any time of the day. However, there are durations of high volatility throughout which it might be difficult to obtain a great fill.

Some Known Factual Statements About Best Broker For Forex Trading

As any type of various other market, during durations of instability slippage is always a possibility. Greater liquidity likewise makes it tough to manipulate the marketplace in an extended way. If several of its participants try to adjust it, the participants would call for huge quantities of cash (tens of billions) making it virtually difficult.

We will speak about this later on. The Forex market is an around the clock market. Best Broker For Forex Trading. This indicates that you can open up or shut any position at any moment from Sunday 5:00 pm EST (Eastern Criterion Time) when New Zealand starts operations to Friday 5:00 pm EST, when San Francisco ends procedures

Some brokers supply up to 400:1 utilize, suggesting that you can regulate for circumstances a 100,000 US dollar transaction with just.25% or US$ 250. If the utilize is not effectively made use of, this might likewise be a drawback.

We will go deeper in to this in the following lesson Because of this, making use of leverage more than 50:1 is not suggested. Bear in mind: the margin is utilized as a deposit; every little thing else is additionally in danger. The Forex market is considered among the markets with the most affordable costs of trading.

Not known Facts About Best Broker For Forex Trading

There are 2 essential gamers you can't bypass in the international exchange (FX) market, the liquidity suppliers and brokers. While brokers link investors to liquidity providers and implement trades on part of the investors.

Brokers are individuals or firms who stand for traders to deal possessions. Consider them as intermediaries, promoting transactions in between investors and LPs. Without them, traders would run into difficulty with deals and the smooth circulation of trade. Every broker needs to get a license. They are controlled by monetary regulatory bodies, there are over 100 regulative bodies globally, these bodies have differing degrees of emphasis and authority.

Get This Report on Best Broker For Forex Trading

After the celebrations concur, the site web broker forwards the LP's offer to the investor. As soon as the cost and terms are satisfactory, the trade is implemented, and the asset is relocated. To summarize the symbiotic dance, each event take their share of the earned charge. On-line brokers charge the trader a payment while LPs earn revenues when they get or sell possessions at successful prices.

We have actually offered three examples to illustrate the partnership in between these events. Digital Communication Networks (ECNs) attach investors to numerous LPs, they provide competitive costs from this source and clear implementation. Right here the broker itself works as the LP, in this version, the broker takes the contrary side of the profession. This version proposes faster execution however, it raises feasible conflicts of rate of interest.

When both celebrations are on the same page, the relationship in between both is usually useful. A collaboration with LPs makes it much easier for brokers to satisfy different trade proposals, generating even more clients and improving their business. When on-line brokers accessibility several LPs, they can visit this website provide competitive prices to investors which improves enhanced customer satisfaction and commitment.

10 Easy Facts About Best Broker For Forex Trading Described

Let's study the key locations where this collaboration beams. This partnership assists to broaden the broker's funding base and enables them to offer bigger profession dimensions and deal with institutional customers with significant financial investment needs. It likewise broadens LPs' reach with validated broker networks, hereby providing the LPs access to a broader pool of prospective customers.

Report this page